Adjusting Bond Allocation for Retirement

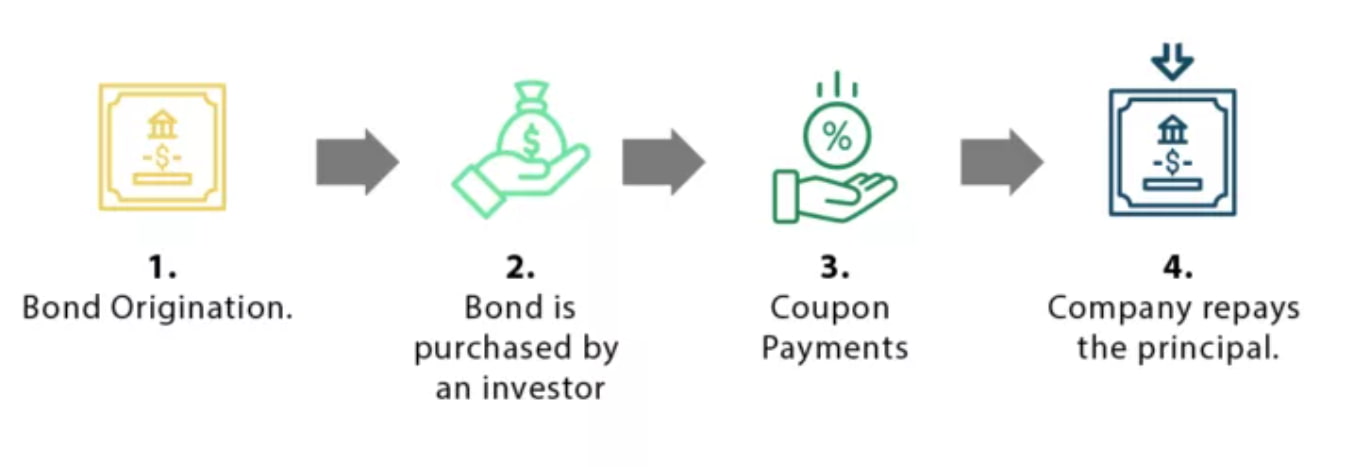

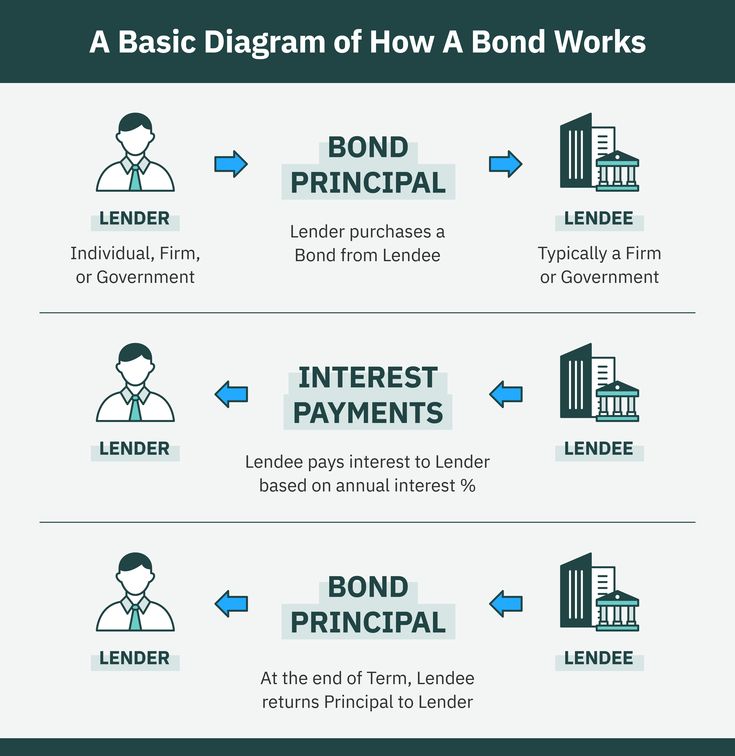

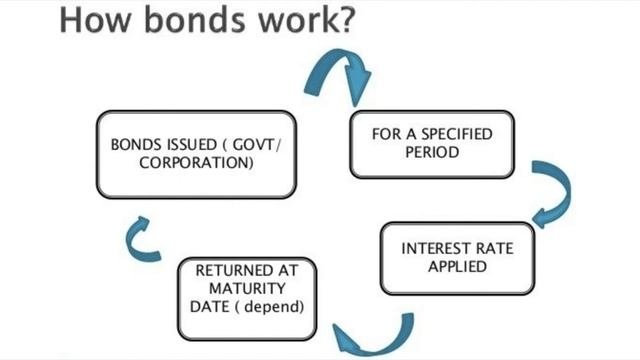

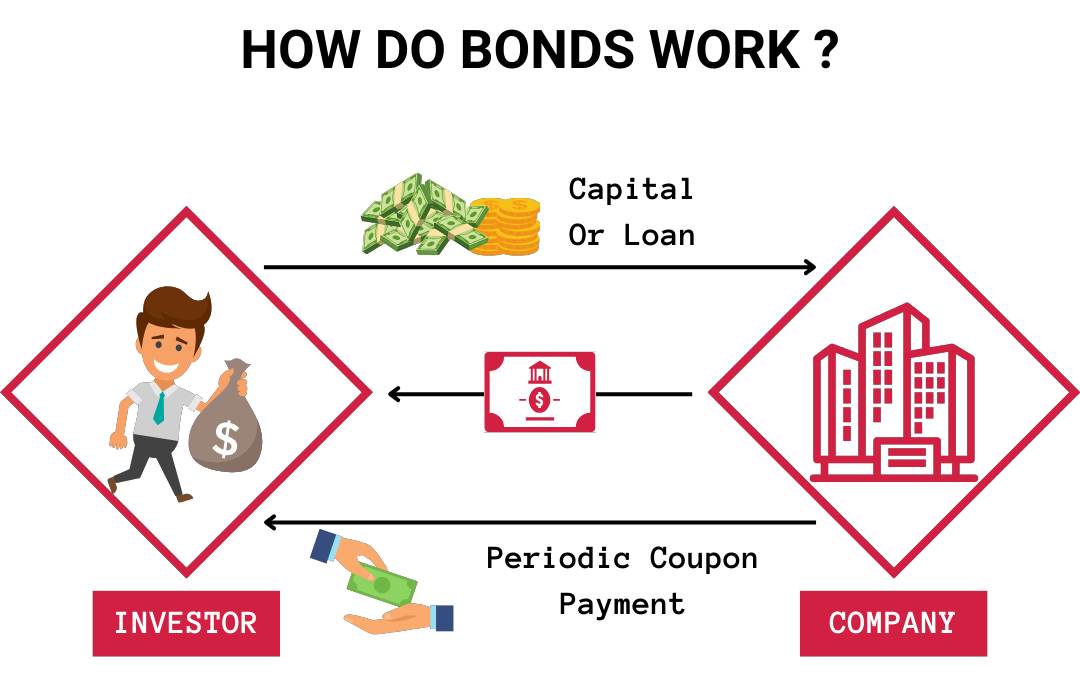

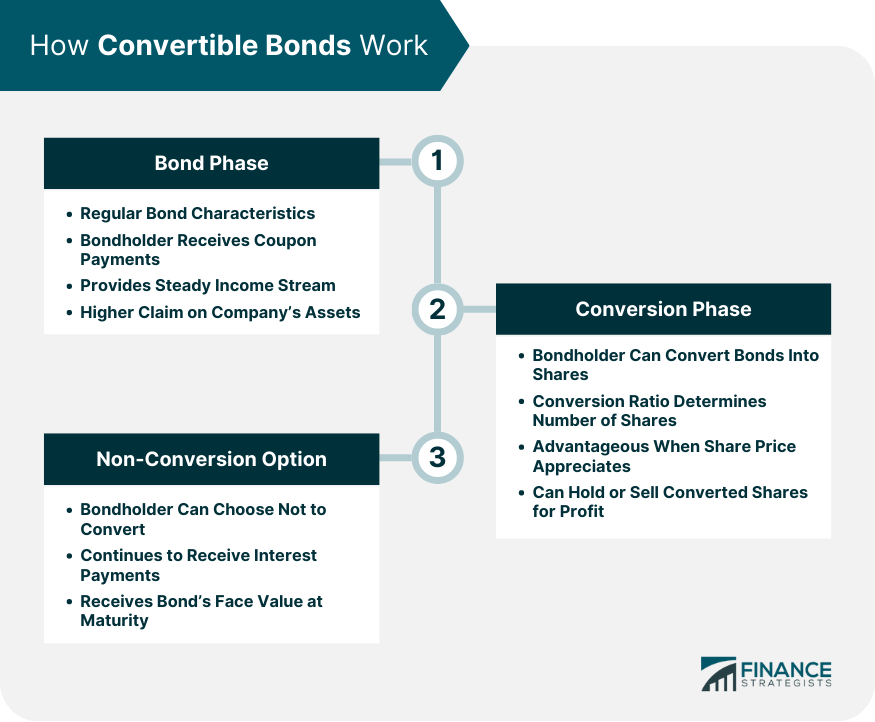

Bonds are a stabilizing force in portfolios, offering steady income and shielding against market fluctuations. By investing in bonds, you lend money to entities in return for interest payments and principal repayment. High-quality bonds, such as U.S. Treasuries, provide stability during market do...